Is it OK to Cancel Motorcycle Insurance in Winter?

For many motorcyclists, especially those living in regions with harsh winters, there comes a season when the roads are less friendly, and bikes are put to rest until warmer days. This period of inactivity often leads to the question of whether you can cancel your motorcycle insurance in winter.

While the temptation to save money during these months is understandable, several important factors must be considered before making such a decision. Alternatives such as adjusting coverage levels or opting for a lay-up policy can provide a middle ground, offering some level of protection and potential savings without the drawbacks of complete cancellation. Ultimately, the decision should be made with a thorough understanding of your needs, risks, and the implications of canceling coverage. Working with our legal team is the best way to negotiate an insurance policy that reflects your current riding needs while saving you money.

For more information about planning your insurance, call Jerry Friedman today at 1-800-529-4464.

Can I Cancel My Motorcycle Insurance in Winter?

Many motorcyclists in colder climates face a seasonal riding pattern because of winter weather conditions. This reality prompts whether maintaining an active insurance policy throughout these off-season months is necessary or financially prudent. Fortunately, our motorcycle accident attorney can help determine what is right in your situation. While the temptation to save money by canceling insurance during this period is understandable, several important factors must be considered before making such a decision.

The first consideration is the legal requirement for insurance. In many jurisdictions, laws require that all registered vehicles maintain a minimum level of insurance coverage, which often includes vehicles that are not in use or stored.

Before deciding to cancel your motorcycle insurance, check with your local Department of Motor Vehicles (DMV) or equivalent authority to understand the legal implications. Failing to comply with mandatory insurance laws can result in fines, penalties, and complications with future insurance coverage.

The potential savings from canceling an insurance policy for the winter months might seem appealing, but it’s essential to weigh these against the risks. Without insurance, you are financially vulnerable if your motorcycle is damaged or stolen during storage.

Comprehensive coverage, which protects against such risks, is particularly relevant in this context. Additionally, consider the potential costs of reinstating insurance, including any fees or increased premiums because of a lapse in coverage.

Storing a motorcycle doesn’t eliminate all risks. Theft, vandalism, and accidental damage, such as from a fire or natural disaster, can occur at any time, regardless of whether the bike is in use. Comprehensive insurance coverage during the winter protects against these risks, providing peace of mind that your investment is protected.

Are There Alternatives to Canceling My Motorcycle Insurance in Winter?

There are very good reasons for keeping some level of insurance on your motorcycle during the off-season. Even when not in use, motorcycles are susceptible to risks such as theft, vandalism, or damage from unforeseen incidents like fires or extreme weather events. The following alternatives can help you save money while still maintaining some level of protection on your bike:

Reduced Coverage Options

One practical alternative to canceling your insurance policy is adjusting your coverage to reflect the reduced risk during this period. Many insurance providers offer the flexibility to tailor your policy according to seasonal use.

One way to adjust your policy is to switch to comprehensive-only coverage. This type of coverage removes the liability and collision portions of your policy, which are less relevant when your motorcycle is parked.

Comprehensive coverage keeps your bike protected against theft, environmental damage, and other non-collision risks at a lower premium than a full coverage policy. In other words, you will be covered for damages that occur from things like storms, fire, or theft but not for damages caused by a collision with another vehicle. This adjustment is a practical way to make your insurance more affordable during the winter months.

Lay-Up Policies

If you own a motorcycle that you only use seasonally, you might be interested in a “lay-up” policy offered by some insurance companies. This type of policy is designed to provide coverage for your bike during the time of the year when you actually use it while also taking into account the fact that it’s not in use during other parts of the year.

Essentially, the policy allows you to pause or significantly reduce certain coverages during the off-season while still maintaining comprehensive coverage. This means that you will still be protected from things like theft, vandalism, and weather damage, but you will not have to pay for coverage that you do not need while your motorcycle is in storage. With a lay-up policy, you can enjoy the peace of mind that comes with having essential protection without breaking the bank.

Payment Plan Adjustments

Another approach that you might consider is discussing payment plan adjustments with your insurer. Many insurance companies are willing to work with their clients to create a payment plan that suits their financial situation. This could involve spreading out your payments over a longer period of time or even pausing your premiums during the winter months when you might be facing higher energy bills or other expenses.

This type of flexibility is not always available, and it will generally depend on your specific insurer and policy. However, if you have a good track record of making timely payments and have maintained a good standing with your insurer, it is certainly worth inquiring about what options might be available to you. By exploring different payment plan adjustments, you might be able to continue enjoying the full coverage that you need while also managing your budget more effectively.

Speak with Your Insurer

Another good strategy would be to have a detailed discussion with your insurance provider to explore alternative options. By doing so, you can gain insights into the options available within your current policy and make adjustments that align with your off-season needs.

During this discussion, be sure to ask about any potential impacts on your premiums or coverage levels before making changes. For example, some insurance providers might offer reduced rates for storage or lay-up periods, which can save you money while still keeping your motorcycle insured.

Alternatively, you might be able to adjust your coverage levels to better align with your off-season usage, which can also help reduce your premiums.

Ultimately, the key to finding an alternative to canceling your motorcycle insurance is to work closely with your insurance provider and explore all of the options available to you. With a little bit of research and planning, you can create a policy that meets your needs while also helping you save money over the long term.

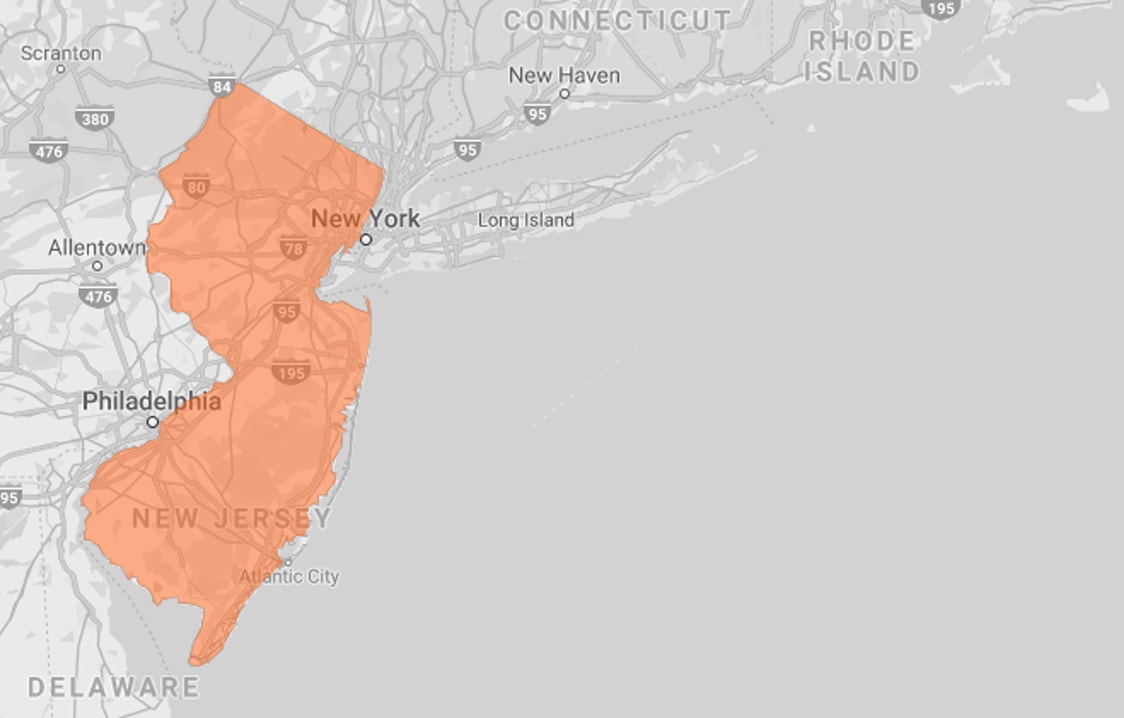

Our New Jersey Motorcycle Accident Lawyer Can Help You Plan Your Insurance Needs

Call Jerry Friedman at 1-800-529-4464 to learn more about canceling your insurance and how it can impact you.